Features of Capital Budgeting

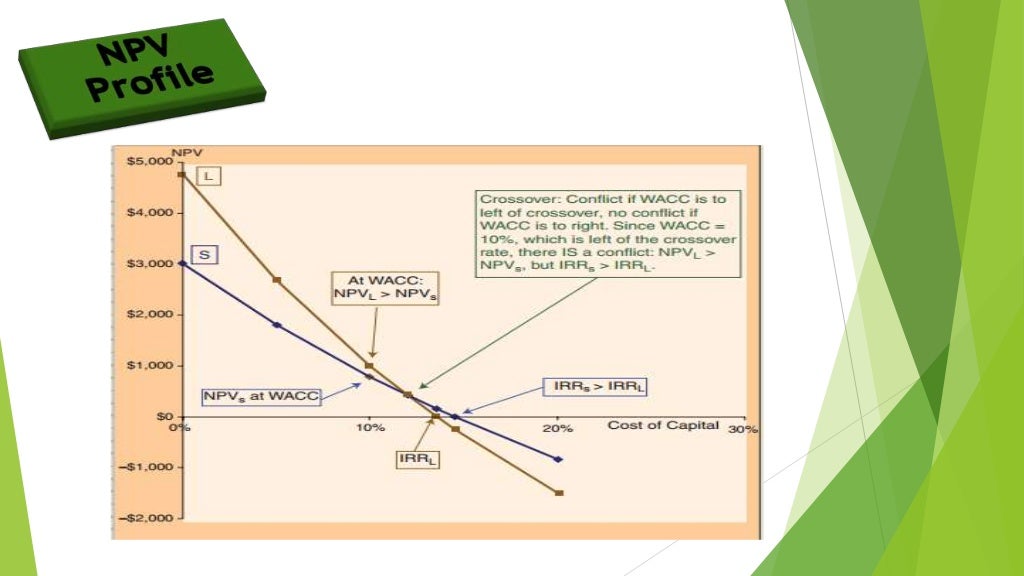

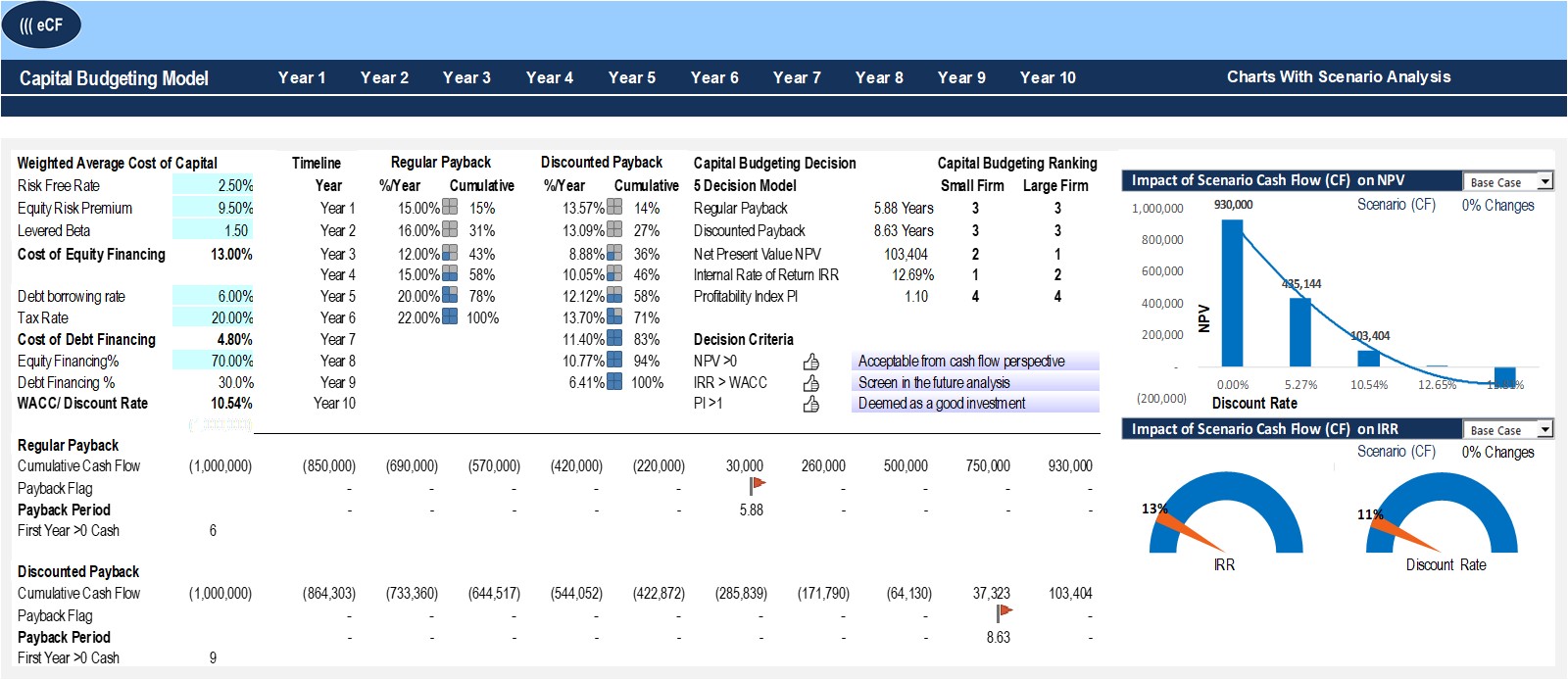

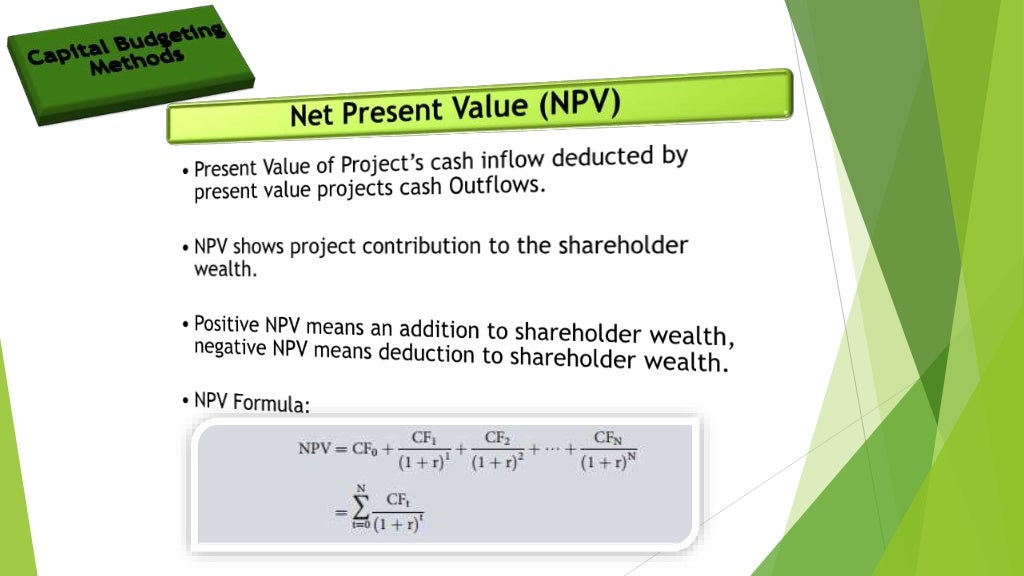

This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contactScholarWorks@blogger.com: Michael Van Roestel The first two papers focused on capital budgeting choices. Findings emphasised that the use of sophisticated capital budgeting and cost of capital estimation methods such as NPV and CAPM was widespread in Swedish listed companies. However, also unsophisticated accounting based methods were employed. Overall, findings suggested that Swedish companies used Capital Budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. Using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners. Capital asset management requires a lot of

What is Capital Budgeting?

proposition on the usage of capital budgeting methods and theories on the Icelandic market. The highlights of the results are that the cases within this study make a similar use of capital budgeting methods and theories as could be expected based on the trend from other markets, drawn from literature review. Size of companies is the strongestFile Size: KB This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contactScholarWorks@blogger.com: Michael Van Roestel capital and others. Financial resource is one of the key elements in achieving organizational objectives and goals. However, in order to achieve the objectives budget has to be prepared effectively and adhered to. A budget may be described, as a quantitative expression of a plans and the process of converting plans into budget is

capital and others. Financial resource is one of the key elements in achieving organizational objectives and goals. However, in order to achieve the objectives budget has to be prepared effectively and adhered to. A budget may be described, as a quantitative expression of a plans and the process of converting plans into budget is proposition on the usage of capital budgeting methods and theories on the Icelandic market. The highlights of the results are that the cases within this study make a similar use of capital budgeting methods and theories as could be expected based on the trend from other markets, drawn from literature review. Size of companies is the strongestFile Size: KB As capital budgeting evolved from financial economics (Haka, ), the majority of studies in this area employ methods embedded within a mainstream (positivist)

The first two papers focused on capital budgeting choices. Findings emphasised that the use of sophisticated capital budgeting and cost of capital estimation methods such as NPV and CAPM was widespread in Swedish listed companies. However, also unsophisticated accounting based methods were employed. Overall, findings suggested that Swedish companies used proposition on the usage of capital budgeting methods and theories on the Icelandic market. The highlights of the results are that the cases within this study make a similar use of capital budgeting methods and theories as could be expected based on the trend from other markets, drawn from literature review. Size of companies is the strongestFile Size: KB This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contactScholarWorks@blogger.com: Michael Van Roestel

The first two papers focused on capital budgeting choices. Findings emphasised that the use of sophisticated capital budgeting and cost of capital estimation methods such as NPV and CAPM was widespread in Swedish listed companies. However, also unsophisticated accounting based methods were employed. Overall, findings suggested that Swedish companies used This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contactScholarWorks@blogger.com: Michael Van Roestel Capital Budgeting is defined as the process by which a business determines which fixed asset purchases or project investments are acceptable and which are not. Using this approach, each proposed investment is given a quantitative analysis, allowing rational judgment to be made by the business owners. Capital asset management requires a lot of

No comments:

Post a Comment